Future-Proof Your Kid's Education: Tips to Save for College

Future-Proof Your Kid's Education: Tips to Save for College

Blog Article

Navigating College Expenses: Specialist Financial Planning Guidance for Students

As college tuition proceeds to increase, pupils are faced with the complicated task of navigating their costs. In this discussion, we will certainly explore different techniques for comprehending college expenses, producing a budget plan, exploring monetary aid options, saving on supplies and textbooks, and taking care of living expenses.

Recognizing College Expenses

Comprehending university expenditures is essential for pupils and their households in order to make educated economic choices and prepare for the costs connected with higher education and learning. University expenditures incorporate a wide variety of monetary responsibilities that pupils need to consider before starting their academic journey. These expenses include tuition charges, holiday accommodation prices, books and products, meal plans, transportation, and various costs.

Tuition costs are commonly the biggest cost for trainees, and they vary depending on factors such as the kind of establishment, program of research, and residency condition. Lodging costs can vary dramatically depending on whether students choose to live on-campus, off-campus, or with family members. Books and materials can additionally be a significant expense, specifically for programs that call for specific materials. Dish plans, transport, and various expenses, such as club costs and after-school activities, should additionally be factored into the general budget plan.

To acquire an extensive understanding of college costs, pupils and their households need to investigate the details costs connected with the institutions and programs they are taking into consideration. They ought to additionally explore prospective resources of financial assistance, scholarships, gives, and work-study opportunities to assist counter some of these expenses. By recognizing college costs, pupils can make informed decisions regarding their economic future and ensure that they are appropriately prepared to meet the monetary demands of greater education and learning.

Developing a Budget

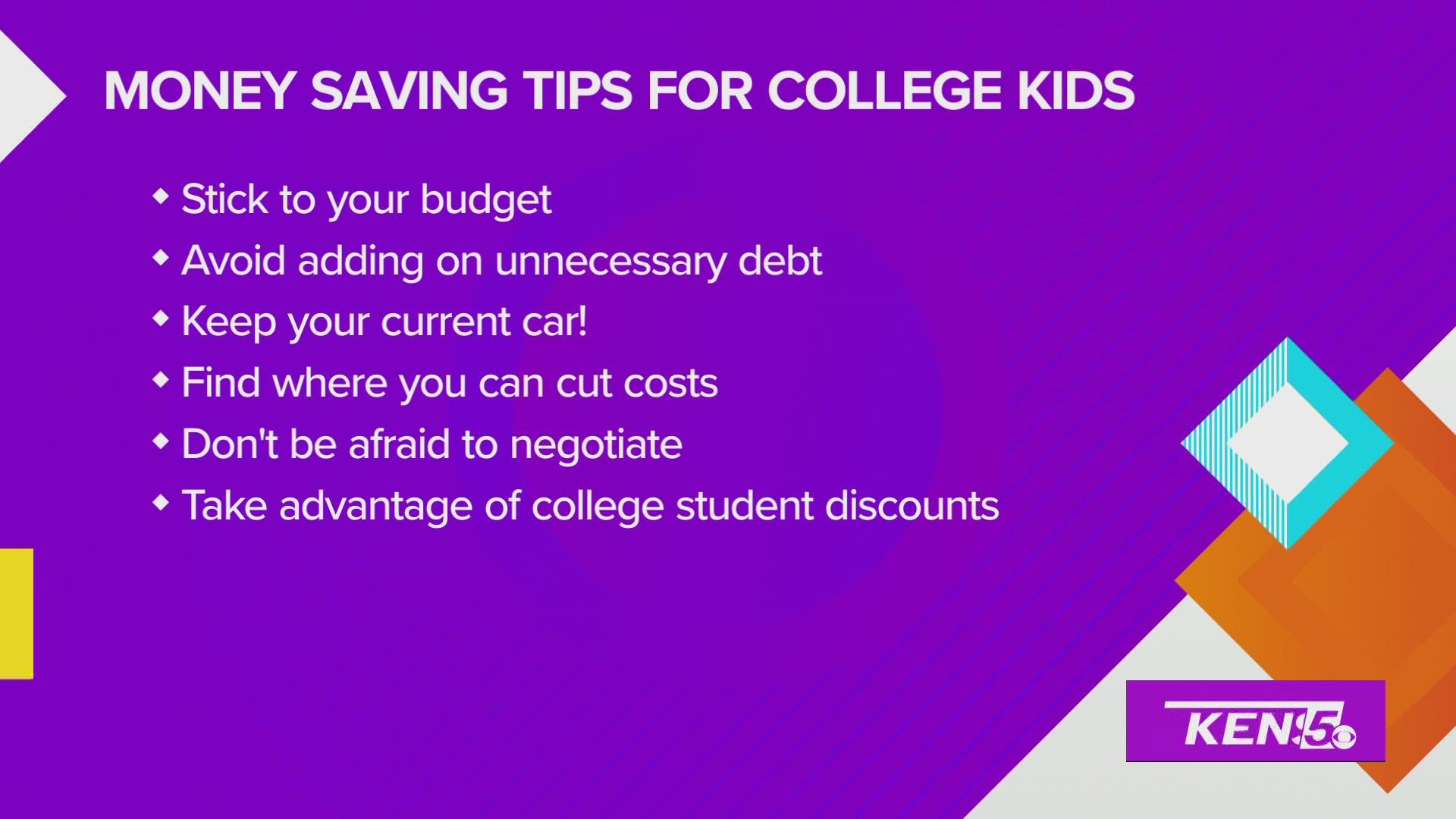

To successfully take care of university expenses, students and their families have to develop a budget that accounts for all monetary responsibilities and makes sure liable investing throughout their scholastic trip. Creating a budget is an important action in monetary planning, as it allows individuals to track their income and costs, and make notified decisions about their spending practices.

The primary step in producing a budget plan is to figure out all sources of earnings. This may include scholarships, grants, part-time jobs, or payments from member of the family. Save for College. It is essential to have a clear understanding of the complete quantity of money available each month

Following, trainees must determine all needed costs, such as tuition fees, textbooks, food, transportation, and housing. It is important to prioritize these expenses and allot funds appropriately. Furthermore, pupils need to likewise think about reserving money for emergencies or unanticipated costs.

Once revenue and costs are identified, it is necessary to track investing regularly. This can be done with budgeting apps or straightforward spread sheets. By keeping track of expenses, trainees can identify areas where they may be spending beyond your means and make modifications as necessary.

Producing a budget not only aids students remain on track financially, yet it also advertises responsible costs routines that can be carried right into the future. By establishing a spending plan and sticking to it, pupils can navigate their college expenditures with confidence and simplicity.

Exploring Financial Aid Options

They do not need to be settled, making them an appealing option for several trainees. It is important for trainees to study and apply for scholarships that straighten with their rate of interests and qualifications.

Grants are an additional type of monetary aid that does not need repayment. These are normally awarded based upon financial requirement and are given by the federal government, state governments, or universities themselves. Students need to complete the Free Application for Federal Trainee Help (FAFSA) to determine their eligibility for gives.

Lastly, trainee car loans are an additional option for financing university expenses. Unlike gives and scholarships, fundings have to be paid back with passion. Students ought to meticulously consider their lending choices and obtain only what is required to prevent too much debt.

Reducing Textbooks and Materials

As pupils discover financial aid choices to ease the worry of college costs, locating means to save money on textbooks and supplies ends up being essential (Save for College). Textbooks can be a significant expenditure for pupils, with prices typically reaching numerous bucks per publication. There are several strategies that pupils can employ to conserve cash on these crucial sources.

Another option is to buy made use of books. Lots of college campuses have bookstores or online industries where pupils can sell and buy made use of textbooks, typically at considerably decreased prices.

Pupils can likewise check out electronic options to physical textbooks. Electronic books and on the internet resources are becoming significantly prominent, providing pupils the ease of accessing their needed reading products digitally. Additionally, some internet sites use totally free or low-cost textbooks that can be downloaded and install or accessed online.

In terms of products, trainees can conserve money by purchasing in mass or benefiting from back-to-school sales. It is additionally worth talking to the university or university's book shop for any type of discounts or promos on products. Pupils must consider borrowing products from schoolmates or buddies, or making use of university resources such as libraries and computer labs, which commonly give access to needed products at no price.

Managing Living Costs

Handling living expenditures is an important aspect of university economic preparation - Save for College. As a student, it is very important to produce a budget plan that makes up all your essential living costs, such as real estate, food, transport, and energies. By taking care of these expenditures effectively, you can ensure that you have enough money to cover your fundamental requirements and prevent unnecessary monetary anxiety

One way to handle your living expenditures is to discover budget-friendly housing options. In addition, discover various meal strategy choices or cook your very own meals to save cash on food costs.

To efficiently handle your living costs, it is important to track your spending and develop a regular monthly budget plan. This will certainly aid you determine locations where you can reduce back and save cash. Search for pupil discount rates or totally free occasions on school for entertainment alternatives that won't damage the bank.

Conclusion

In conclusion, comprehending university expenditures and creating a budget are important actions for pupils to properly manage their finances. Discovering financial assistance choices and discovering means to minimize books and products can also aid alleviate a few of the monetary problem. Furthermore, handling living costs is necessary for pupils to remain on track with their financial resources. By implementing these techniques, trainees can navigate college expenses and improve their financial wellness.

By recognizing university expenses, trainees can make educated choices concerning their economic future and make certain that they are properly prepared to satisfy the monetary demands of higher education.

As pupils discover economic help alternatives to relieve the worry of university expenditures, discovering methods to save try this out on textbooks and materials becomes crucial.

Report this page